If you're thinking of buying a home, you've probably heard the term 'pre-approval' but many people don't know or fully understand what it is! I'm excited to chat with you guys about the pre-approval process today and answer some frequently asked questions!

If you're thinking of buying a home, you've probably heard the term 'pre-approval' but many people don't know or fully understand what it is! I'm excited to chat with you guys about the pre-approval process today and answer some frequently asked questions!

What is pre-approval for buying a home?

Pre-approval is basically a lender getting a snapshot of your financial picture and your home-buying goals. By gathering pieces of your financial history, a lender can help you determine what you may be able to qualify for as well as what loan product will be the best fit for you.

Why do I need to get pre-approved?

There are many reasons why pre-approval is not only necessary, but beneficial for you! Often people don't realize how much money they will actually need to put down and how that relates to how much house they want to buy. Different down payments affect your monthly payments, mortgage insurance etc. Loan originators can run different scenarios for you to help you best determine what strategy you want to take when deciding critical factors like house cost and size. For example, you may think you will save money buy buying a smaller condo, but after figuring in monthly HOA's and property taxes for the area you could realize that a single family home actually ends up being more affordable.

A common mistake that people make is thinking that a loan product their sister/friend/parent used will work the same for them. Although it could work for you as well, that is not a safe assumption to make. No two loans are alike just as no two peoples finances and life circumstances are exactly the same. Your loan officer will ask you a lot of questions to help you determine what your best options are.

How can a loan officer help me?

A loan officer is there to help educate you on what you need to bring to the loan, how the loan process works, and what products that are available will work for you. They will provide you with a loan estimate that will help you to visualize what your loan costs will be, this won't be exact at your initial meeting but it can give you a good idea of what your loan may cost. Every loan product has different costs.

Perhaps one of the biggest reasons to get pre-approved is so that you are comfortable shopping for a house that you know with certainty you can afford and make payments on. Being pre-approved shows buyers that you are serious and prepared to make an offer. In some competitive markets people won't even consider an offer unless a pre-approval letter comes along with it.

Is it hard to get pre-approved?

Getting pre-approved is a pretty simple process. You need to know your financial situation (like how much money you consistently make and how much debt you have and what those debts are) and articulate it clearly to your lender. Your lender will have to pull your credit, but it shouldn't hurt your score to have it pulled once. Your lender will require you to provide them certain documents to prove your finances are as you states. Gathering all these documents (tax returns, bank statements etc.) can feel like busy work and is typically the hardest part for you. If you cannot obtain pre-approval this is a pretty clear sign that you are not ready to buy a house yet, if this happens your lender can help you to know what you need to change or improve before trying again.

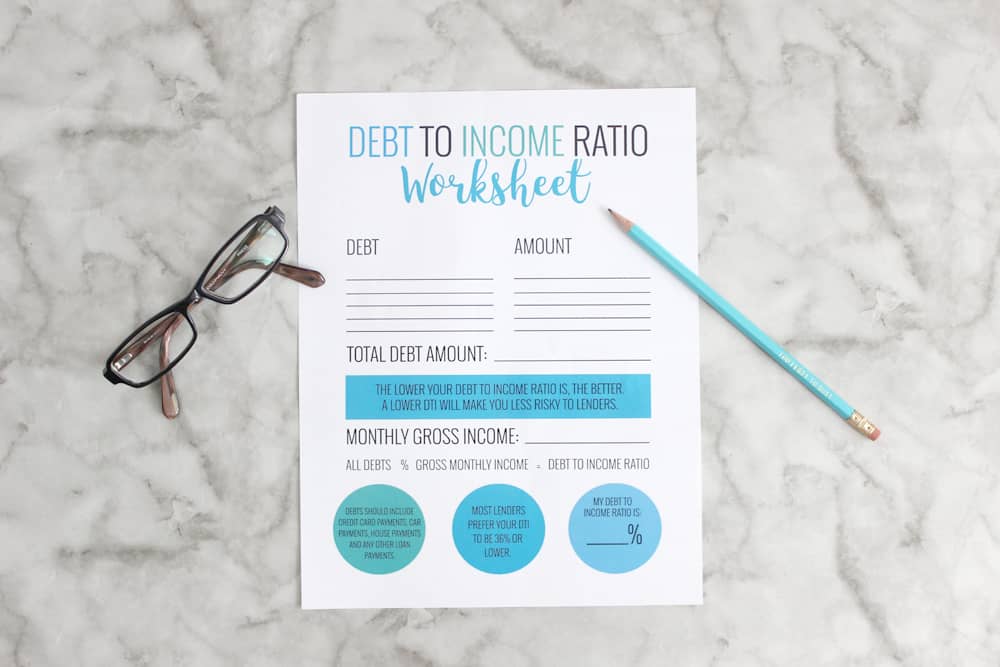

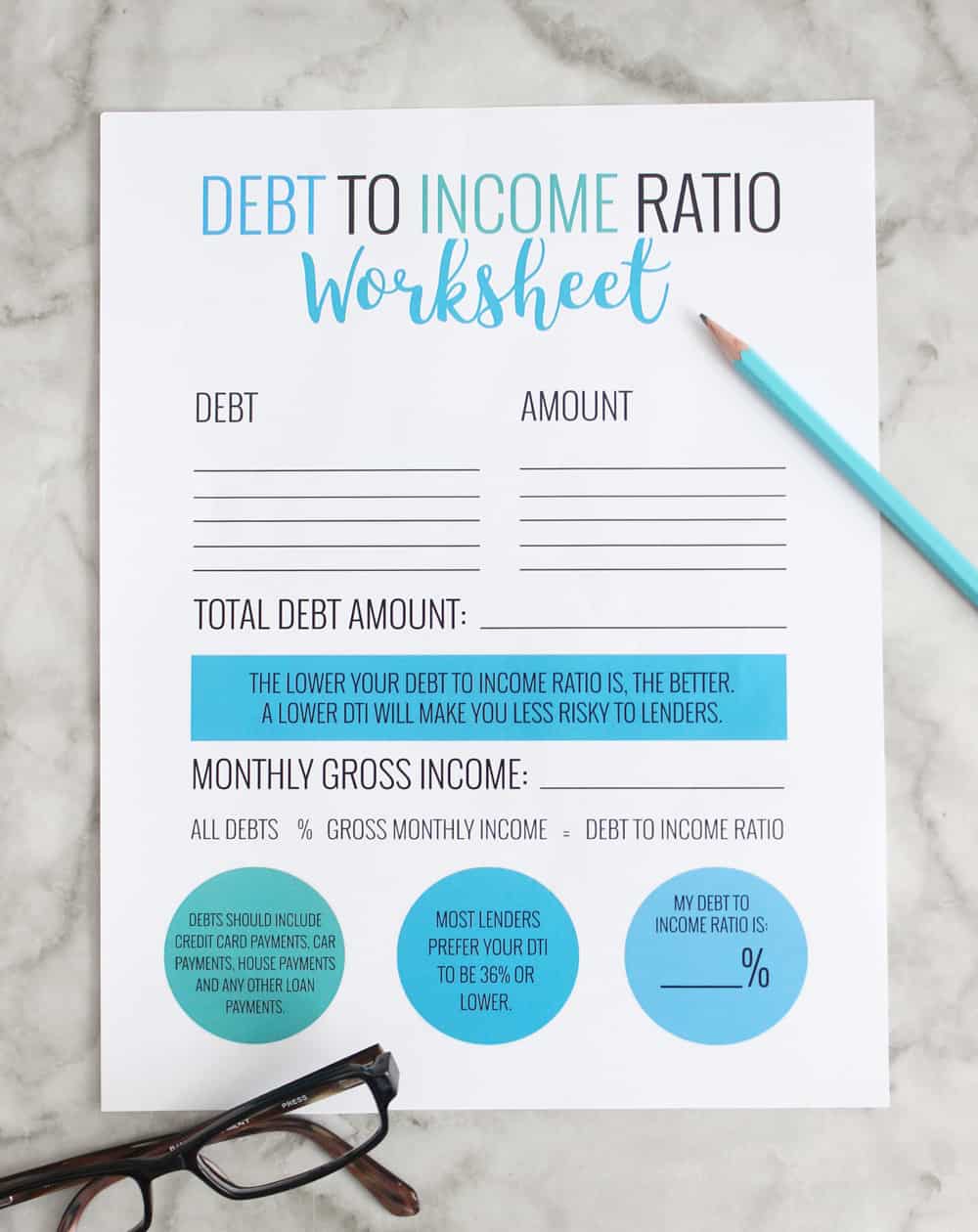

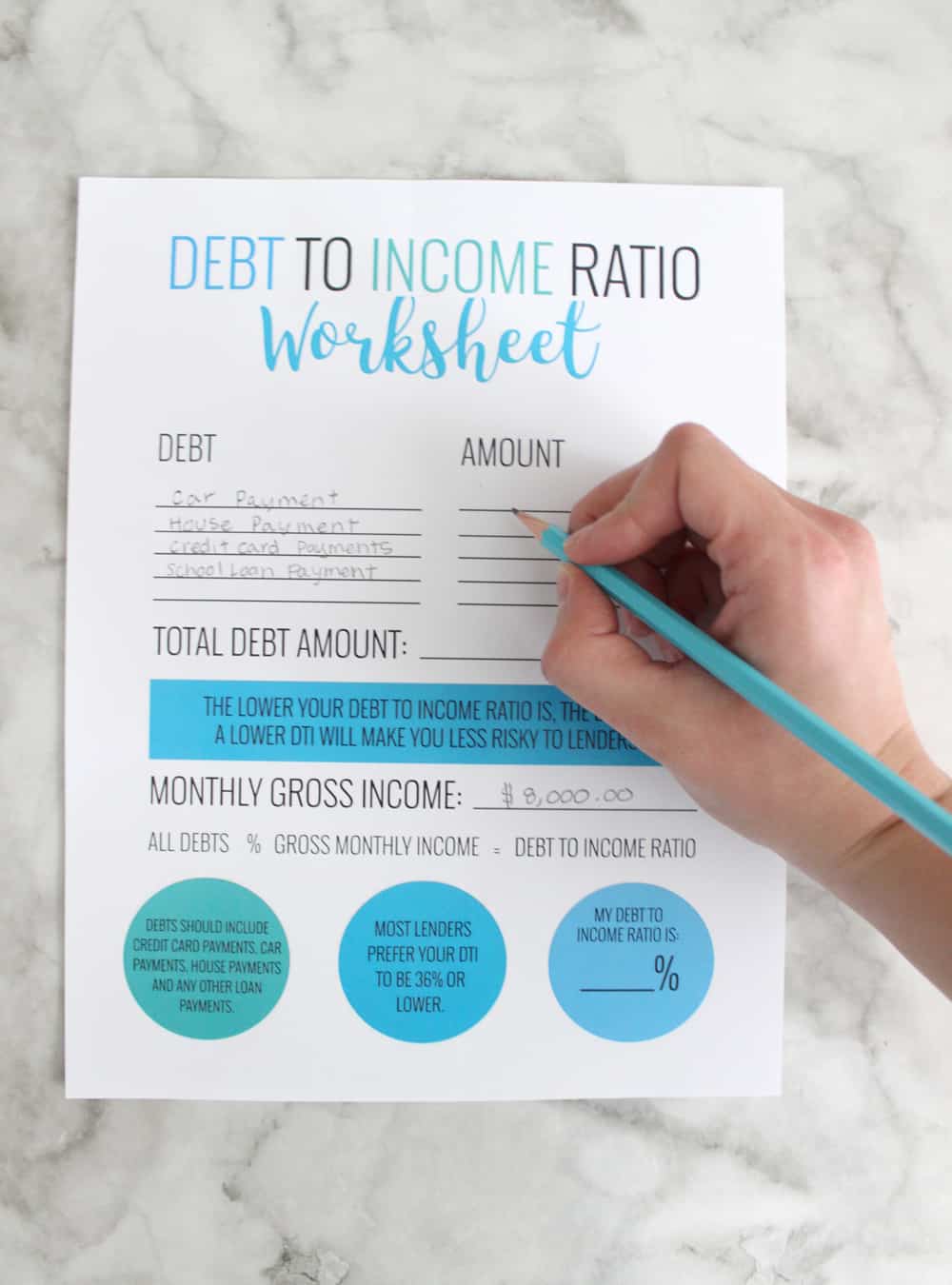

If you want to have an idea of whether or not you will get pre-approved before choosing a lender to help you, a good first step is finding out your debt to income ratio, or DTI. The lower your debt to income ratio is, the better. A lower DTI will make you less risky for lenders. All though each loan product is different most lenders would prefer your debt to income ratio is at 36% or lower. I made a simple worksheet to help you deduce your own debt to income ratio easily, you can download and print yours here.

Should I always take the loan with the lowest interest rate?

While it is obviously very important, how high or low your interest rate is is not the only indicator as to whether or not you got a good loan. Occasionally when comparing lenders people can get hung up on a great rate without looking at the other fees involved, and sometimes if those other feels are significantly higher it can make up the difference of a slightly better rate.

One key thing to look for is your APR or annual percentage rate. Your annual percentage rate is the amount of interest on your total loan amount that you will pay annually, because it is averaged out over the entire term of your loan. It should be listed on your loan documents alongside your interest rate. The closer your APR is to your actual interest rate, the better your loan value is. When comparing loan products, it often makes the most sense to choose the loan product with the lower APR.

Good luck friends!

xo,

* This post was originally written for and posted on the HouseLogic website and can be found here.

Donald Wilson

I would like permission to use your DEBT to INCOME ratio form on my website

I am teaching a biblical finance class and I want to teach about DTI and your form is great

please reach out to me and let me know

Thank You

Donald Wilson